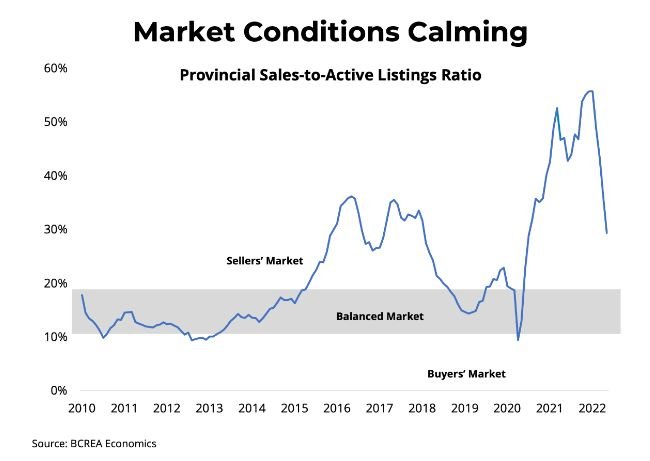

Rising mortgage rates are continuing to slow real estate market activity, according to a report by the British Columbia Real Estate Association.

BCREA reports that 8,214 residential unit were sold in May 2022, a decrease of 35.1 per cent from May 2021. The average MLS® residential price in BC was $1 million, a 9.3 per cent increase from $915,392 recorded in May 2021.

However, total sales dollar volume was $8.2 billion, a 29.1 per cent decline from the same time last year.

“Canadian mortgage rates continue to climb,” said BCREA Chief Economist Brendon Ogmundson. “The average 5-year fixed mortgage rate reached 4.49 per cent in June. That is the highest mortgage rates have been since 2009.”

However, active listings still remain below what is typical for a balanced market, though current market conditions have a high degree of variation across regions and product types, Brendon said.