By Gagandeep Ghuman

Published: May 18, 2013

Call it a double triple-whammy.

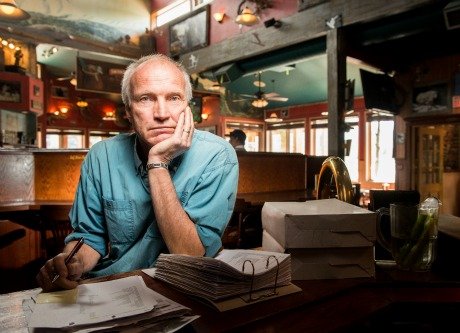

Firstly, fewer construction workers poured into the Shady Tree Pub since the buzz of Olympics died out.

Secondly, the new drinking and driving laws, and their aggressive enforcement, kept people away from the pub. Thirdly, liquor prices went up with the reordering of the HST.

Now, pub owner Eivind Tornes prepares for the next triple whammy: A 15 per cent increase in utilities, a 10.2 increase in residential taxes, and a 10.4 per cent in business taxes.

“In my 20 years of business here, I’ve never seen such tax increases,” he says.

It’s a story many businesses can relate to.

Shady Tree did steady business since it first opened its doors in 1987, but the year 2011 marked a downward turn.

Tornes has had to lay off staff, and watch his costs.

And now, the district wants him to step up and pay more.

“How are they going to attract business if they keep penalizing it with more taxes,” he says.

Similar questions and worries have coursed through the mind of Vickie Nickel, the owner of Glacier Interiors in the Industrial Park.

Nickel pays nearly $10,000 dollars in property taxes and close to $900 in utilities for her commercial business.

Increasing taxes by more than ten per cent is just plain bad for business and worse for business confidence when there is no extra amenity or service to show for it, she says.

“Business has been bad in this area since 2008, and by increasing the taxes, you are just going to hurt them more,” she says.

It also deters other businesses to come to Squamish, she adds.

Kicking the backbone

Small businesses are the backbone of B.C. economy.

They account for about 98 per cent of all business in B.C., and employ 56 per cent of private sector workforce. According to the Canadian Federation of Independent Businesses (CFIB), the tax share for small businesses is growing slowly across the province.

CFIB, an organization whose findings don’t find much favour with elected officials, says the average property tax ratio of business taxes to residential taxes has grown from 2.42-to-1 in 2003, to 2.97-to-1 this year.

The district is aiming to keep the gap low, but those noble intentions are nullified by the actual increase in business taxes.

Last year, the average business tax increase in Squamish was 4.6 per cent.

The year before that, the increase was 6.2 per cent. This year, it’s an unprecedented 10.4 per cent.

Compared to the BC average of 20 per cent, Squamish businesses also contribute 26 per cent from the tax base.

Former mayoral candidate and council watcher Auli Parviainen says the increase in business taxes is ‘counter-intuitive to economic development’.

“If they are paying more now, are we giving them value? How else are we helping them, what else are we doing for them?”

Glacier Interior owner, Vickie Nickel, has an answer.

“As far as I know, nothing…I’m not getting any additional amenities or services for paying more,” she says.

Industry is gone, with nothing to replace it

Councilors will eagerly tell you how policing and other core service changes have led to an increase in taxes. But what has really led to the tax increase is the fact that Squamish has lost much of its industrial tax base.

In the year 2000, residential taxes accounted for 48.6 per cent of the tax revenue, while major industry contributed 28.52 per cent of the tax revenue.

Fast forward ten years, and the equation has changed.

In 2010, residential property taxes brought in 59.2 per cent, while major industry (port), brought in 2.10 per cent.

If you remove the port, then contribution of major industry was zero per cent.

Even as Squamish devolves into a bedroom community, consecutive councils have done precious little to revive industry, or create the right environment for business investment.

While the previous council paid lip service to economic development by creating a clumsy strategy, this council has resisted the creation of a separate economic development commission with an adequate budget to go after business investors.

But as our story on Maple Ridge shows (see related link on main page), a committed economic development officer with support from council can turn things around.

Squamish has at least borrowed a part of its downtown revitalization plan from Maple Ridge.

Will it work?

Business owners like Tornes and Nickel would be watching.

Frank W Baumann says

Sometimes you have to be really careful not to get what you ask for. When I first moved to Squamish, the forest industry was alive and well- providing well-paying jobs, millions in municipal taxes, and a real sense of community. Same with Woodfibre- the mill was humming along, providing millions of dollars in wages and taxes to the community. Both industries used renewable resources, utilized under stringent environmental standards. Oh sure, there were temporary changes to the land- clearcuts and resource roads that are now largely overgrown and greened up; hardly noticeable when one flies along the Coast these days. Later came the run of river power projects- over a dozen projects provided hundreds of millions of dollars in investment and, more important, clean, renewable energy for the future. While they were being proposed and built, there was a legion of nay sayers who claimed that these projects were almost the worst thing that ever happened to the planet. So what happened? Well, the projects turned out to have far less of an impact than anyone ever thought; hardly anyone even notices them anymore, as they quietly hum along and provide hundreds of megawatts of clean power to the B.C. Hydro grid- power that offsets our need to import electricity from coal or nuclear generating plants in Washington State and Alberta. Now we see a similar opportunity with liquified natural gas (LNG)- a commodity that we have in abundance in B.C., and that can be extracted with very limited environmental impacts, despite all the misinformation we hear about fracking (please show me one study that proves that deep fracking has any impact on groundwater resources, or the surface of the land). Also missing from the debate is an essential fact that seems to have been lost in the fray: every time we replace a coal fired generating plant on the planet with one that uses LNG, we reduce carbon emissions by roughly 50%. Oh sure, if we increase LNG production, Canada’s export of products that produce carbon emissions will increase- but the net impact on the planet will be a vast reduction in greenhouse gases. That is not as good as providing power from renewable energy sources, or jobs from renewable resources, like the forest industry- but we’ve gone down that road before and decided that we’d rather live without those industries, and maintain our current life styles by some other means that no one has yet explained to me.

Frank W Baumann says

Oh, and before someone raises the conservation argument (all we need to do is to remember to turn the lights off and our power shortages will disappear)- let me remind everyone that when we make a specific commitment to use less electricity for only one hour a year on Earth Day, the total demand typically drops by less than 2%, according to B.C. Hydro (http://www.bchydro.com/news/press_centre/news_releases/2012/bc-hydro-repeats-earth-hour-success.html). So what electrical appliance are you willing to turn off? How much are you willing to put on a sweater and turn down your household thermostat?

And then there’s the complaint about the cost of renewable power produced by the independent power producers. Well, again, let me remind everyone that it was B.C. Hydro that was in the driver’s seat with regard to negotiating those contracts- and I have complete confidence that the Directors wouldn’t have sold the farm; that is, wouldn’t have entered into power purchase agreements and contracts that were more expensive than B.C. Hydro’s own costs. Quite the contrary. Furthermore, my bet is that in 40 years, when we see what the overall cost of that power really has been, those projects will be viewed as visionary as the B.C. Hydro heritage dams built by W.A.C. Bennett in the 1960’s- never mind the non-renewable energy they will have displaced.

LArry McLennan says

There are two basic industries upon which all others are based.These are mining (oil, metals, gravel etc) and agriculture (forestry, fishing , farming). Without these basic industries nothing can occur (even hunting gathering is based on these industries). BC and Canada are blessed with an abundance of resources to be used for Canadian benefits and for other peoples’ benefits. Our standards of use are as good as it gets in the world. These industries (fishing, forestry and mining) provide top wages for workers and allow for those workers to distribute their earnings to the less basic service and entertainment sectors. These industries also often proivide significant tax bases to communities .Don’t like personal property taxes and small business taxes going through the roof? Start supporting some of the basic industry proposals.

Dave says

You maybe surprised at this Larry but I support you on this!

It would be nice if you could ,at least, listen to some of the others too…sometimes!

“Davey boy”

Eric Andersen says

Well stated, Frank and Larry! Good common sense community economic development wisdom.