By Gagandeep Ghuman

Published: July 2, 2013

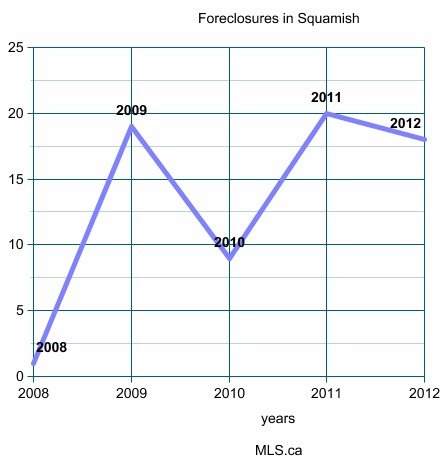

As many as 80 homes went for foreclosure sales in the last five years in Squamish.

A whole array of residences—condos, single detached, mobile homes—were up for foreclosures sales in the past five years.

Foreclosure, the process of taking possession of a property as a result of the mortgagor’s failure to keep up payments, has become synonymous with the recession that marked a downward spiral in America’s economy.

Even though Canada’s economy is known to have weathered the recession better than the US, its housing market wasn’t completely immune from the crippling effects of the recession.

Squamish, too, had its share of difficulties, and foreclosure numbers throw a hint.

Start with 2008.

In that year, just when the storms of recession were brewing, there was only one that was a foreclosure sale.

It was a manufactured home in Britannia Beach.

In 2009, the increase is dramatic: As many as 19 homes went up on a foreclosure sale in Squamish.

This pattern more or less continues to this day.

In 2010, for example, there were 9 homes for foreclosure. Out of them, there were two mobile park homes, four condos, and three single-family detach homes.

In 2011, the numbers go up again.

There were 20 homes that were up for foreclosure sales; in 2012, the number goes to 18.

By the middle of this year, that number stands at 15.

It’s hard to make a solid connection between recession and job loss and why people stop making payments for their home.

Recession and job loss seems like a plausible reason why people would stop making payments on a home.

But it isn’t the only one: Divorce, household debt, and death in the family are other factors that might lead to a foreclosure sale.

Still, the numbers for foreclosures are high for a town the size of Squamish, said Peter Belostotsky, a realtor with Squamish Century 21.

Recession and speculative buying in the lead up to the Olympics could have led to an increase in foreclosures sales, he said.

It’s notable that the 80 homes are the ones that were listed on MLS; private sales, for example, are not included in this number.

A foreclosure property can present a good opportunity, Belostotsky said.

Foreclosures aside, it’s a buyer’s market in Squamish.

It’s a sellers’ market if more than 15 per cent of the existing inventory of homes is sold in a month.

In Squamish, that number hovers about 3-4 per cent.

“This is a huge buyer’s market,” Brawley said.

Dave says

There is a contributing reality which underpins some of this.

There is a trend in our “civilised” society to want the whole lot too early. To do this you need a job but there is a tendency, among the young particularly, to use the plastic card excessively, to maybe smoke, party and have kids. Its so easy to build a debt which, though manageable all the while the job is there, disaster can strike very quickly with redundancy.

This is even worse if you have a mortgage. Advice: Don’t spend beyond your means and pay off the accumulate on your card each month to avoid crippling interest rates.

If you can’t do this then tear up the card and trim your life-style.